Budget has to be a crucial part of money management. Financial literacy and budgeting as whole make your money last for the good along with allowing you to make more out of them. Personal finance budgeting apps are the answer if you’re looking for easy budgeting ways. We have made a list of Best Free Budgeting Apps UK that can help you survive the ongoing inflation. The personal finance apps UK will help you track, categorize and organize your money in the best possible way.

Budget by Koody

Budget by Koody being one of the top UK Personal Finance Apps is for money management and budgeting through which you can keep track of your finance and take full control of the amount you spend as a whole. You don’t need to connect your bank application with this app; Koody offers all the perks without it. This app will set your daily spending limit, give you overview of your monthly expenses according to your monthly budget. This app is for free yet if you want access to more features then you can get the subscription according to your preferences.

Website: www.koody.co

Moneyhub

Moneyhub being one of the top UK Budgeting Apps for Students consists of intelligent tools that help you to keep track of your finances. You can access the app in any of your devices and it’ll show your all of your accounts, investments and spending in one go. The insights this app gives will help you to modify your behavior when it comes to budgeting. You can categorize your transactions through this very app as well. Our favorite feature is their Spending Analysis feature that shows you exactly where you spent all the money. This is where you can have your spending targets and the application assists in the correct spending.

Website: www.moneyhub.com

Snoop

This app enables you to see all of your bank accounts in one location. Similarly, you can set spending goals, alerts and summaries as well. Snoop, being the Best Money Management Apps UK favorite feature is their discount code finder that shares the voucher codes that can save your money. Overall Snoop’s features will help you take control of your bills.

Website: www.snoop.app

Revolut

Revolut is yet another free Top-Rated Budgeting Apps in the UK that offers amazing features. This app allows you to make your daily spending, a smooth process. Revolut will calculate the limit of spending and recommend according to the budget you give it. The app makes sure that you’re getting weekly insights for a better idea of where are you actually spending. In this way you can control your subscriptions, budget things and get visibility of your spending habits.

Website: www.revolut.com

Plum

Plum aims to help you with your finances and enables you to save more. This app automates your investments and deposits while automatically switching your utilities. You get an overview of your finances so you can keep track of your spending in best possible way. You can also earn interest on your savings if you get subscription of Plum Pro.

Website: www.withplum.com

Emma

Emma is one of the Top Budgeting Apps UK that can help you with the finances by categorizing your expenses, helping you to set budgets and save money. The tool that comes with the app gives you clear insight and helps you to make smarter spending decisions. You can track all of your savings and investments here including your investments in crypto.

Website: www.emma-app.com

Cleo

Cleo is a budgeting and saving app that gives you budgeting tips, spending overview and personalized budgets. The smart chat bot in the app keeps the fun intact while managing your finances. Our favorite part has to be when the app goes on roast mode and turn red when you spend more than the budget. This is indeed one of the Best Budgeting Apps UK offering various budgeting solutions to clients.

Website: www.web.meetcleo.com

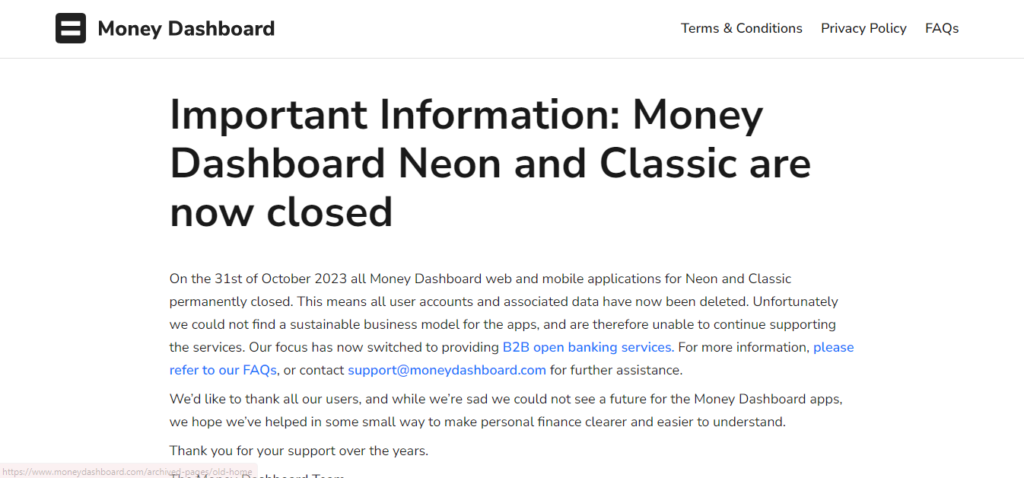

Money Dashboard

Money Dashboard is a best expense tracker app uk and personal finance and budgeting at its best. It keeps track of your spending and accounts collectively. It connects all of your accounts and then manages the transactions collectively. You can track all of your accounts and wallets; all through this one app. Money Dashboard ensures effective money management through forecasted cashflow and strategic approach.

Website: www.moneydashboard.com

Curve

Curve consolidates your bank accounts and tracks all of your accounts while providing you with the curve card facility. The app categorizes all of your spending and make sure that it’s all controlled and in the budget. The premium account users also get access to insurance facility.

Website: www.curve.com

HyperJar

Adults and kids can use the HyperJar money app and prepaid debit card. It helps you keep tabs on your expenses by letting you allocate your funds to various jars for various purposes and make appropriate purchases from each. Additionally, the app is totally free. From the analysis of more than 1500 reviews it received, Trustpilot has rated it at 4. 7 out of 5. 0.

Website: https://hyperjar.com

Starling Bank

Starling Bank is an app-only challenger and one of the best expense tracking app UK that has won awards. The elements the challenger bank is proposing to customers include; 3. Free current account with 25% interest, numerous detailed budget applications, and much more. The challenger bank which started in 2024 has gained some acceptance and boasts of a score of 4. 3 out of 5. Meanwhile, Marson received an impressive 0 on the Danish online rating site Trustpilot which collects over 40,000 customers’ responses.

Website: https://www.starlingbank.com

Bank Chase

Bank Case, launched in September 2021, is one of the Best Budgeting Apps for UK Households and newcomer to the UK market. That said, J.P. Morgan owns the challenger bank, and has more than 50 million active users in the US alone. Do consider Chase Bank if you like your current account to come with interest and cashback. This is so because Chase Bank has been commissioned with dynamism of 4. 2 out of 5. At the moment, its overall rating on Trustpilot is 0 and there are 9,191 people’s reviews.

Website: https://www.chase.com

Monzo

Monzo is an app-only bank with several useful Budgeting Tools for UK Families for budgeting. However, you’ll probably need to select one of the paid plans in order to take use of all that it has to offer in terms of budgeting. The least expensive is Monzo Extra, which has extra budgeting tools and costs E3 a month.

Website: https://monzo.com

Conclusion

Financial planning is thus indispensable to any organisation in this modern world to ensure organisational financial survival. The right budgeting app will enable one to track his/her spending and also set certain barriers that will ensure he/she attains his/her financial objectives. From apps like Koody and Moneyhub with intuitive expense tracking tools for insights into user expenditure, to those like Snoop or Revolut, which analyze spending habits across multiple accounts, there is an array of options tailored toward the needs of each individual.