Credit cards can be good management of money if used correctly, especially where one is able to benefit from the cashback and rewards. The right credit card may enhance your buying experience and at the same time, you earn, be it if you are a big buyer, a traveler or a food lover. Below are some of the Best UK credit cards, where we look at options such as incentives and cashback facilities.

American Express Platinum Cashback Credit Card

Perhaps the most preferred and loved cashback credit card in the United Kingdom is the American Express Platinum UK cashback credit cards. Cardholders are only limited to receive a good amount of cashback depending with their regular spending since the rate of cashback provided is at 1.25% for most of the transaction. In fact it can be considered one of the most profitable options for those who want to get the maximum of the money they spend because in the period of introducing new clients it grants up to 5% of the cashback on the first £2,000 during the first three months. In addition, American Express comes with a set of online tools to help you manage your cashback reward and cash in.

- Website: www.americanexpress.com

- Phone Number: 0800 917 8047

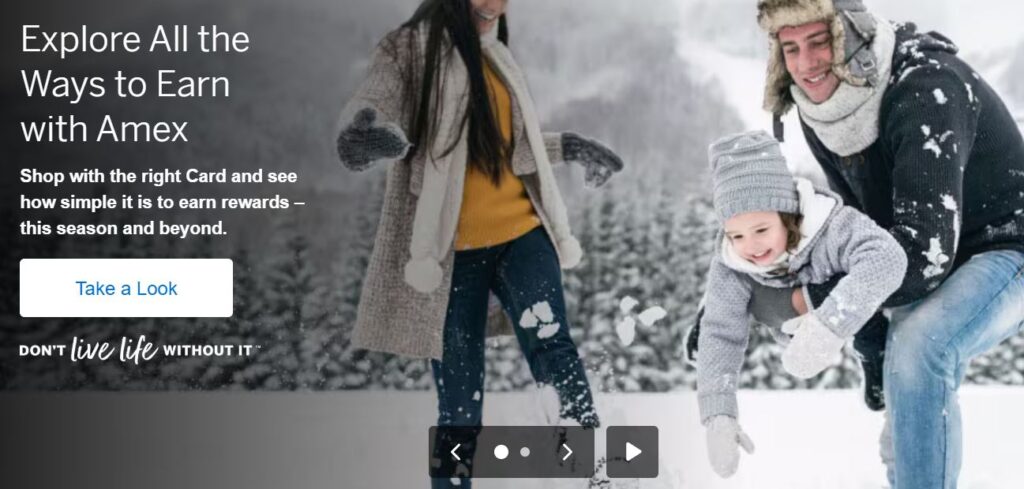

Barclaycard Rewards Credit Card

Barclaycard Rewards Credit Card is perfect for individuals who are seeking a basic Credit card rewards programs UK, with no foreign transaction fees. But one has to remember that the big advantage of this card with a 0.25% basic cashback, which applies to every purchase made, is the fact that this cashback accumulates with the numerous customers who make relatively small and often individual purchases alternatively. Also, Credit card benefits UK that users can get are sometimes made available depending on the special offers available are even more easily accessed through the Barclaycard app. No foreign transaction fees is much appreciated from tourists from other countries since it enables them to avoid spending more money when shopping abroad. Also included is purchase security, which makes you feel safe when making costly buys.

- Website: www.barclaycard.co.uk

- Phone Number: 0800 151 0900

Santander All in One Credit Card

There are no capped on how much cashback a customer is able to earn for using the Santander All-in-One Credit Card, which offer customers 0.5% cashback on all spending they do. Thus, it will help cater to the people who wish to get the most of their daily spending without tempting them to over-budget. Similarly, the card does not attract international transaction fees which are especially useful for the global citizens who would like to avoid extra costs each time they have to make a purchase in their new country of residence. Like most UK rewards credit cards out there, the Santander All-in-One Credit Card also comes with some travel insurance benefits that include trip interruption and cancellation, loss of baggage and travel accident and medical insurance. For these travel benefits, it is the Best cashback cards UK 2024 for those who need reliable card for everyday usage and during travelling because of it.

• Website: www.santander.co.uk

• Phone Number: 0800 912 3123

Tesco Clubcard Credit Card

For the lovers of Tesco, the Tesco Clubcard Credit Card is among the Best credit cards for points UK. Each purchase made using this card earns members Tesco Club card points that translate to gift cards for future shopping or other incentives such as dining or travelling. It is actually possible to earn up to a triple of the value of the points that the company offers, these being awarded at a rate of 1 point for every £4 spent either online or at any of the company’s outlets. Clubcard is one of the most flexible and popular loyalty programmers in the UK and therefore is an ideal option for those who want to earn their incentives fast at Tesco. Also, one cannot speak about annual charges to worry about.

- Website: www.tescobank.com

- Phone Number: 0345 300 4278

M&S Bank Shopping Plus Credit Card

If you are a frequent shopper at Marks & Spencer, the M&S Bank Shopping Plus Credit Card is the Best credit cards for shopping UK since users gain point for each sale. These vouchers can actually be got through conversion of all these points into food, clothing, home and personal products from respective M&S stores online or physical stores. Also, there are often two bonus tiers that allows cards to accumulate even more points in certain categories of purchases, such as food or apparel if the cardholder makes the purchases frequently. One of the best parts of this card is you get to see your points and use it to shop at M&S with a platform that is very real.

• Website: bank.marksandspencer.com

• Phone Number: 0345 900 0900

Virgin Atlantic Reward Credit Card

People who travel often and wish to be earning their Flying Club miles every time they spend should apply for Virgin Atlantic Reward Credit Card. Such miles can translate to flying, Seventh Airlines can use these miles to book a flight, lodge or any other travel-related reward such as hotel or a lounge. In addition to the earning of miles through Virgin Atlantic flights, this card permits the earning of miles through ordinary purchases, making it easy to build up travel perks without having to make other bookings. Virgin Money as a rule provides bonus terms that allow customers earn more miles, especially when they travel by flight or make particular kinds of purchases. Because of this it makes the card very useful for those people wishing to maximize the benefits that they get from their travels.

- Website: uk.virginmoney.com

- Phone Number: 0800 917 7495

Halifax Clarity Credit Card

Presenting one of the most ideal travel-friendly and Top UK credit cards for cashback, Halifax Clarity Credit Card. They don’t charge international transactions fees, which are hidden charges when using credit cards in foreign nations, despite the fact that it does not give cashback or reward points on purchases. This makes it perfect for foreign visitors who would want to avoid going through exchange rate costs. Furthermore, the card supports reasonable exchange rates that help in exercising efficiency when moving to practically any part of the world outside of the United Kingdom. Halifax also has a comprehensive list of convenient and effective mobile and internet banking features which enable you manage you spending even when on the go.

- Website: www.halifax.co.uk

- Phone Number: 0345 720 3040

NatWest Reward Credit Card

Specifically for those who prefer to gather cash back for their everyday shopping, NatWest is the Reward point’s credit cards UK. If you have ongoing monthly bills like utilities, cell phone, magazines, newspapers etc., you can get cashback for direct debit payments which may all mount up to a significant amount. Additional perks for daily purchases are also available on the card to allow users to gain points and earn cash back on each deal. Also there’s welcoming sign-up rewards for new clients where you can get the chance to earn more cashback from the moment you start with NatWest. This card adorable for individuals, who wants Credit cards with rewards UK without additional complicated points programs.

• Website: www.natwest.com

• Phone Number: 0345 788 8444

Aqua Rewards Credit Card

If you wish to try using cashback with a background of lower than average credit rating, the Aqua Rewards Credit Card is right for you. Nevertheless, with the rise or improvement of the credit score, this card may be useful since it offers the 0.5% cash back on all purchase. The fact that it does not attract annual fees, anyone who interested in earning rewards from High rewards credit cards UK does not have to consider the additional fee. Aqua is ideal for anyone who wants to rebuild their credit score while earning cash back on everyday purchases because this company also provides users with information on and solutions for a better credit profile.

• Website: www.aquacard.co.uk

• Phone Number: 0333 220 2691

Sainsbury’s Nectar Credit Card

Sainsbury’s Nectar Credit Card is useful for the buyers who often shop at Sainsbury’s and who want to build up the amount of Nectar points which are gained for purchasing product and can be exchanged for a lot of things. One of the biggest advantages of collecting Nectar points is the flexibility of the card, meaning it is ideal for anyone who has various spending habits; whether you plan to use the points on entertainment, eating out or holidays or even shopping at Sainsbury’s. You can also gather points at thousands of participating merchants besides Sainsbury’s, so accumulating points for the incentives can be easily accomplished. Sainsbury’s Nectar Credit Card is the best for everyday users if they are in search of an easy-to-use card and no charges apply to them.

• Website: www.sainsburysbank.co.uk

• Phone Number: 0800 030 4429

John Lewis Partnership Card

It will be used for customers who are supporters of both Waitrose and John Lewis brands within the John Lewis Partnership Card. The accumulation of points made by cardholders upon every purchase they make can be redeemed at these two famous stores. The rewards can be used to buy everything starting from groceries, home goods and apparels. Furthermore, it is not only the Best credit cards for groceries UK but also gives you extra chances to win during other special offers making it easier to win prizes. Indeed, one of the major benefits of the card is the affiliation with the John Lewis and Waitrose rewards which help you to maximize the value on what you are buying from both stores. It can be much beneficial if you are a regular shopper at these stores.

• Website: www.johnlewis.com

• Phone Number: 0345 300 3833

Lloyds Bank Platinum Cashback Credit Card

Lloyds Bank Platinum is the Top cashback credit cards UK, especially suitable for those people who prefer to get the reward for practically all their purchases. One can receive up to half a percent of the cash back on each transaction, with an annual fee waived for the first year. It is ideal for those who make frequent, but not necessarily as frequent and large as in the case above, purchases. A real-time tracking of cashback on the Lloyds Bank mobile banking application is possible, further this credit card comes with purchase protection in case of theft, loss or damage to your purchases. In sum, it is a great card for anyone that wants an affordable and easy card with little to no fuss involved.

• Website: www.lloydsbank.com

• Phone Number: 0345 606 2172

HSBC Premier Credit Card

HSBC Australian consumer with account holding HSBC Premier are targeted towards getting the features that are offered in the HSBC Premier Credit Card which include cashback, travel rewards and other privilege dining offers among others. This UK credit card deals allows the cardholder to access airport lounges globally and is embraced by busy travelers. Also, there is a sign-up bonus provided to this card, and first-time users can get extra privileges using this card. It is the best Credit cards for travel rewards UK and is designed to offer great benefits for those who live and work in luxurious manners while they are away from home and when they are dining.

- Website: www.hsbc.co.uk

- Phone Number: 0345 740 4404

Capital One Classic Credit Card

The Capital One Classic Credit Card is the Best credit cards for dining out UK. It is a great one for those young individuals who decided to work and would like to have some cash back points and build up the credit history. Food vendors are ideal especially for those who dine almost every day owing to the payback on restaurants. The main features of this card are that people can spend more while earning rewards for dining out, and it has no annual fees, making it perfect to rebuild credit history. If you are a beginner in credit or if you want to rebuild your credit then this card can be the perfect fit as Capital One has many tools to teach you more about credit as well as help you improve it.

- Website: www.capitalone.co.uk

- Phone Number: 0344 481 4000

Conclusion These are the Best credit cards for everyday spending UK. To get the greatest value out of your cash and to be rewarded at the same time, try to link your spending habits with the most suitable reward and cashback credit card in the United Kingdom. Where one person seeking the simplicity of a quick payback may follow the American Express Platinum payback Card, another person, say a traveler may prefer cards such as the Virgin Atlantic Reward Credit Card, so always consider aspect such as rates of rewards, annual fees, purchase protection or insurance and among other things. You should be able to make good decisions as these Best credit cards for UK consumers will assist stretch daily budgets while gaining cashback or points